Not known Incorrect Statements About Financial Advisor Near Me

Wiki Article

The smart Trick of Financial Advisor Definition That Nobody is Discussing

Table of ContentsThe Facts About Financial Advisor Salary UncoveredThe Of Financial Advisor FeesSome Ideas on Advisor Financial Services You Need To KnowNot known Facts About Financial Advisor MagazineExamine This Report on Financial Advisor Salary

If you're looking for a consultant to handle your cash or to aid you spend, you will need to meet the advisor's minimal account demands. Financial advisor. Minimums vary from advisor to expert.

An additional straightforward way to find economic advisor alternatives near you is to utilize a matching solution. Smart, Possession's totally free economic expert matching device can assist with this, as it will certainly couple you with approximately three regional economic experts. You'll then have the ability to interview your suits to discover the appropriate suitable for you.

The Best Strategy To Use For Financial Advisor

Before conference with a consultant, it's a great idea to assume concerning what kind of consultant you need. If you're looking for particular guidance or services, consider what kind of monetary consultant is a professional in that location.

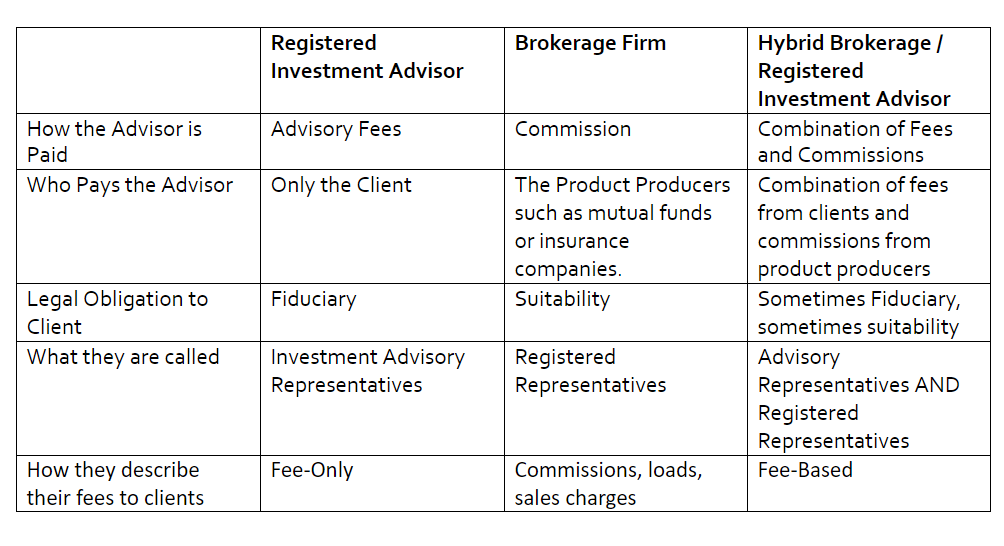

Which one should you deal with? We find that, typically, people seeking financial suggestions understand to search for an economic expert who has high degrees of stability as well as that intends to do what is in their clients' benefit in all times. But it seems that fewer people take note of the alignment of their monetary advisor candidates.

More About Financial Advisor Certifications

Right here's a check out four different kinds of advisors you are most likely to come across and just how they pile up versus each various other in some crucial locations. Armed with this information, you ought to be able to much better evaluate which type is ideal suited for you based upon factors such as your goals, the intricacy of your economic circumstance and your net well worth.Let's take a look at each team. 1. Investment consultant. An excellent way to consider the wide range administration power structure is that it's progressive, or additive. We begin with the base. Financial investment advisors are superb economic experts who do a great work managing moneybut that's all they do. While investment experts give a solitary solutionmoney managementthat one remedy can have numerous variations (from securities to investments secretive companies, actual estate, artwork and also so forth).

, one must first acquire the necessary education and learning by taking financial advisor programs. Financial experts have to have at the very least a bachelor's level, and in some cases a master's is recommended.

Facts About Advisors Financial Asheboro Nc Uncovered

Financial consultants will certainly need this structure when they are suggesting customers on reducing their threats as well as conserving cash. When working as a monetary expert, knowledge of investment preparation might prove essential when trying to devise financial investment strategies for customers., such as transforming a headlight content or an air filter, however take the automobile to an auto mechanic for large work. When it comes to your funds, though, it can be trickier to figure out which jobs are DIY (financial advisor certifications).

There are all kinds of economic pros available, with loads of various titles accountants, stockbrokers, cash supervisors. It's not always clear what they do, or what kind of problems they're outfitted to manage. If you're really feeling out of your deepness financially, your primary step should be to learn who all these various monetary professionals are what they do, what they bill, and what alternatives there are to employing them.

How Financial Advisor can Save You Time, Stress, and Money.

1. Accounting professional The major reason many people hire an accountant is to assist them prepare and also submit their income tax return. An accounting professional can help you: Fill up out your income tax return correctly to avoid an audit, Discover reductions you may be missing out on, such as a house workplace or child care reductionFile an expansion on your tax obligations, Spend or give away to charities in ways that will certainly decrease your taxes later If you possess an organization or are starting a side company, an accountant can do various other work for you.

Your accounting professional can additionally prepare monetary declarations or reports. Exactly How Much They Expense According to the National Society of Accountants, the typical cost to have an accountant file your blog here tax obligations ranges from $159 for an easy go back to $447 for one that includes organization revenue. If you wish to work with an accounting professional for your company, the cost you pay will certainly rely on the size of the company you're advisors financial asheboro nc taking care of and the accounting professional's degree of experience.

Report this wiki page